The Dollar Cost Average or Dollar Average Cost (DCA, for its acronym in English) is a well-known investment strategy used in the crypto world or traditional currency trading.

El The main objective of this strategy is to allow the investor to obtain a significant profit on his total investment in the long term.

This is possible because the DCA helps reduce the impact of price volatility when buying crypto or currency.

How is this possible? This is because making regular purchases of cryptocurrencies or currencies reduces the average price of the purchases made, thereby lowering global volatility and increasing the chances of obtaining better returns in the long term.

Dollar Cost Average: its main advantages and disadvantages

As we discussed, the Dollar Cost Average (DCA) can be a useful tool to reduce investment risk. However, investors using this investment strategy may forgo potentially higher returns achievable by other strategies. This is perhaps its biggest disadvantage, since DCA not only averages the cost of your purchases and investment, but also your earnings.

Another point of the DCA is that it is a long-term strategy, more similar to HODL or conventional savings. This means you hold your cash for longer, which has lower risk but often yields lower returns than investing a lump sum, especially over longer periods of time.

So, for example, if the market rises during a period when you are dollar cost averaging, you may lose potential profits that you could have made if you had invested immediately and all at once.

In addition, we must bear in mind that if we perform a cost average in dollars, it is possible that we apply additional commissions by the platforms where we carry out these operations and that these commissions could reduce the profitability of our investments. Finally, one of its biggest disadvantages is the need for great financial discipline. Managing DCA requires focus on strategy, in its good follow-up and in its execution in an exemplary manner.

Having said all this, we can highlight the following advantages:

- As a first advantage we find that reduce the cost of purchasing your assets.

- As a second advantage, it is important to note that it helps to reduce the risk of your investments.

- Also, it is a good way to save or HODL.

As disadvantages we find:

- Higher costs in terms of transactions, since you must buy regularly, with costs that can vary over time.

- It is a strategy that has a lower return.

- This strategy requires strong financial discipline and constant monitoring of the markets if we want to be successful with it.

Why use the Dollar Cost Average (DCA) strategy?

The objective of the Dollar Cost Average (DCA), is to divide your total investment into smaller portions divided into periods of time, where the purchase of cryptocurrencies or currencies can offer you better results than if you invested all that in a single purchase. The idea is based on an element that we see in the markets all the time: volatility in prices.

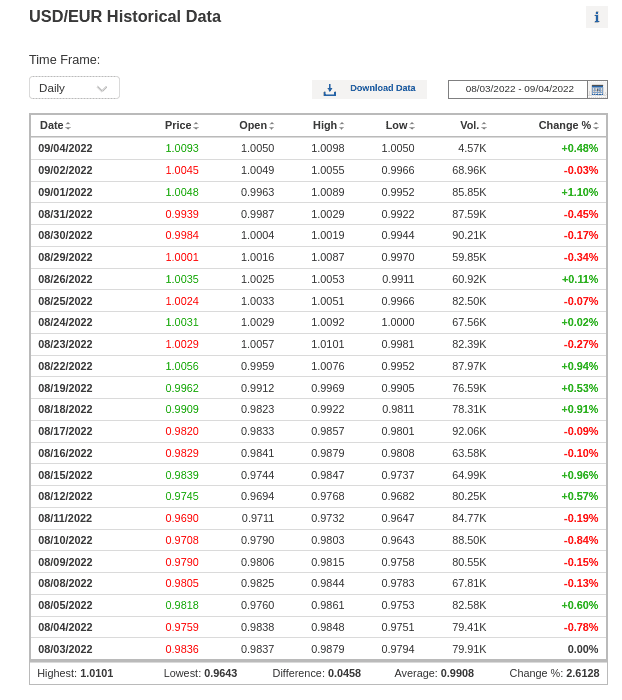

For example, take a look at the following image and the price changes between USD/EUR:

In a market as controlled and "stable" as the USD/EUR currency market is, you can see times where buying USD (or EUR, depending on your strategy) may work out better with a long-term savings perspective. Of course, this does not prevent your money in those currencies from being diluted by inflation and the centralized reality of those currencies.

But. Does the same thing happen in the crypto market? The short answer is: Yes, and we can use it for our DCA strategy.

Observe the following image:

As you can see, there is clearly an average price in this 30-day price history, with daily ups and downs, so it can be more or less positive to buy BTC at a certain time in order to make your money end. obtaining positive returns following a DCA strategy.

In any case, the idea and objective of applying DCA is to smooth the entry into the market so that the risk of bad timing is minimized. In this way, the potential losses that you may have due to a bad decision at a given moment can be fully or partially recovered during future purchases, maintaining a positive return over time.

Now, you must understand that the DCA does not guarantee a successful investment, but it does offer a much more reliable and easy-to-apply tool, especially for those who do not want to participate in much more complex trading strategies, such as quantitative trading or technical analysis. /fundamental.

Example of a DCA strategy

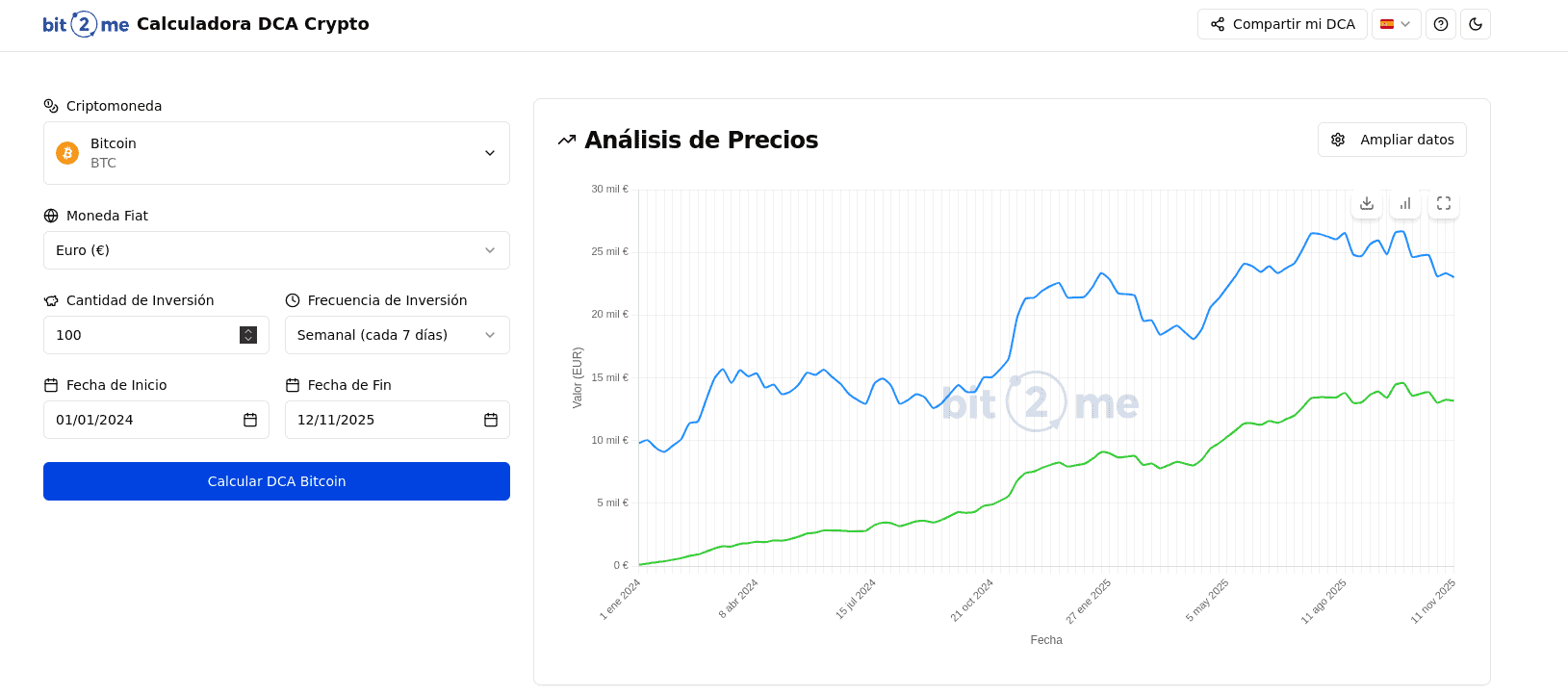

Now let's look at an example of a DCA strategy, and to see it much more clearly, we want to show you our Bit2Me DCA CalculatorA DCA calculator that will help you implement this strategy very easily.

With this tool, you have the ability to calculate a complete DCA strategy with a single click, using cryptocurrencies such as Bitcoin, Ethereum, XRP, Algorand, Cardano, or Hedera.

You will only need to choose one of these currencies, indicate the fiat currency you will use for your purchases and profit calculation (e.g., Euro or Dollar), indicate the investment amount (how much cryptocurrency you will buy with each transaction), the purchase or investment frequency (e.g., weekly), and the start and end dates of your entire strategy.

With this data, you can click on "Calculate DCA" and the tool will calculate the profits of your strategy, presenting you with a graph where you can see the evolution of your purchases and the final profits/losses obtained.

All of this will be detailed in a results table, where you can see all this information in great detail.

Operational example

But let's do an example of DCA using our calculator.

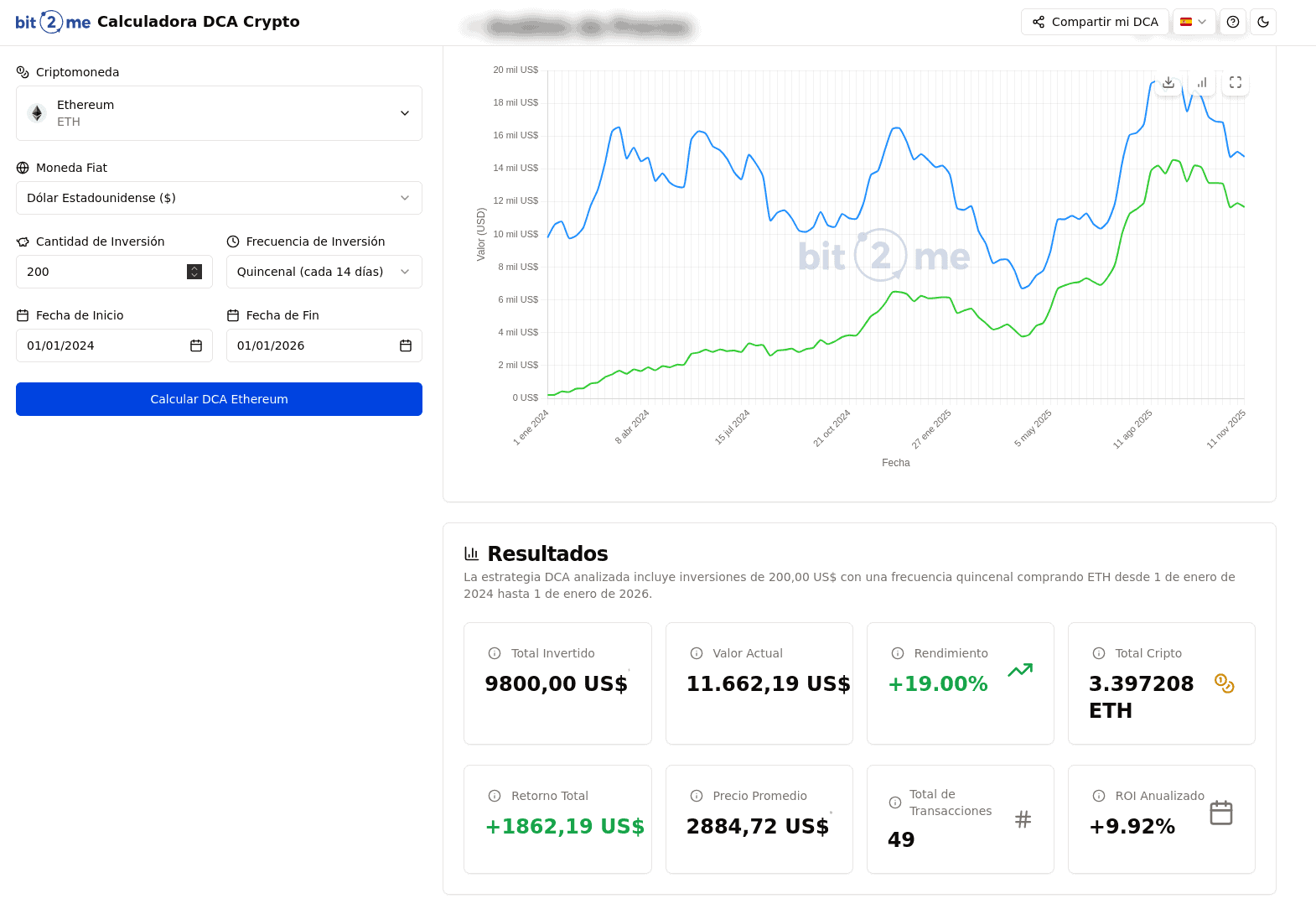

Let's say we want to make a bi-weekly purchase of $200 worth of Ethereum. All we need to do is choose "Ethereum" as the cryptocurrency, dollars as the fiat currency, and specify $200 as the bi-weekly purchase amount.

And along with this, we'll also add the trading dates. Here we'll make another assumption for our example: we'll assume we've been trading this way since January 2024 and want to end our strategy in January 2026. That way, we'd be applying the same strategy for two years, during which we should see the results.

With that information, our calculator gives us the following result:

The results are clear:

- We have invested a total of $9800 during this time

- The final value of our acquired ETH is $11.662,19.

- The return on our investment in ETH is 19%.

- The ETH in our wallet is 3,397208 ETH

- The annualized ROI is 9,92%.

All this data clearly shows that we made money on our ETH purchase if we did it this way. Of course, there were times when the potential profit on our ETH was much higher, as shown in the graph.

For example, if we had withdrawn ETH on December 9, 2024, our investment in dollars would total just under $6600, but the ETH in our possession would be worth $16.000. And this is another point you should keep in mind with DCA: You must maintain buying discipline, but at the same time, be attentive to the market.If you see that market conditions could dilute your investment (a general downturn, for example), a good action is to protect your value in stablecoins.

En Bit2Me For example, you can do a DCA as described here, but if you see that the value and profits of your strategy are threatened by a downturn, you can switch to stablecoins, protect yourself, and wait for the storm to pass.

If the price of the cryptocurrency you're buying is affected during a downturn, you have the opportunity to use your savings to buy more of that cryptocurrency and resume your dollar-cost averaging (DCA) strategy. The long-term result is that you can leverage your investment, meaning your final DCA investment can increase the overall value of your cryptocurrency purchases.

It's all about knowing how to manage risk, and in this case, DCA is a strategy that allows you to control risk very easily. It's no coincidence that companies like Strategy or countries like El Salvador use these types of strategies or approaches in their purchasing. And that's where the true potential of DCA lies—a tool that anyone can use.

It starts at Bit2Me Jump into the world of cryptocurrencies with a head start. Sign up easily and get €15 FREE on your first purchase with this link. Don't wait any longer to join the crypto revolution! Join Now

Author

Author