What is the Bitcoin Halving?

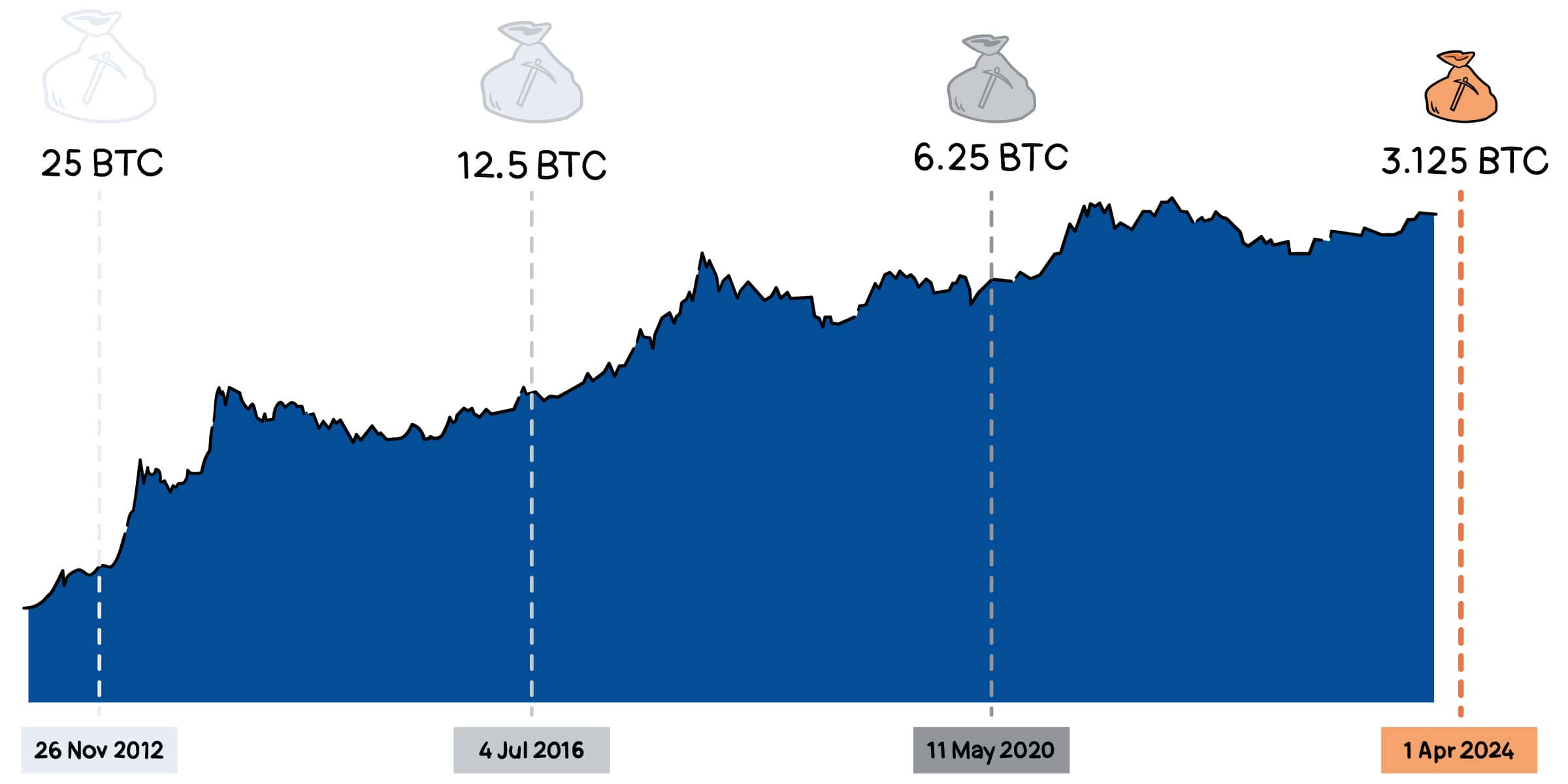

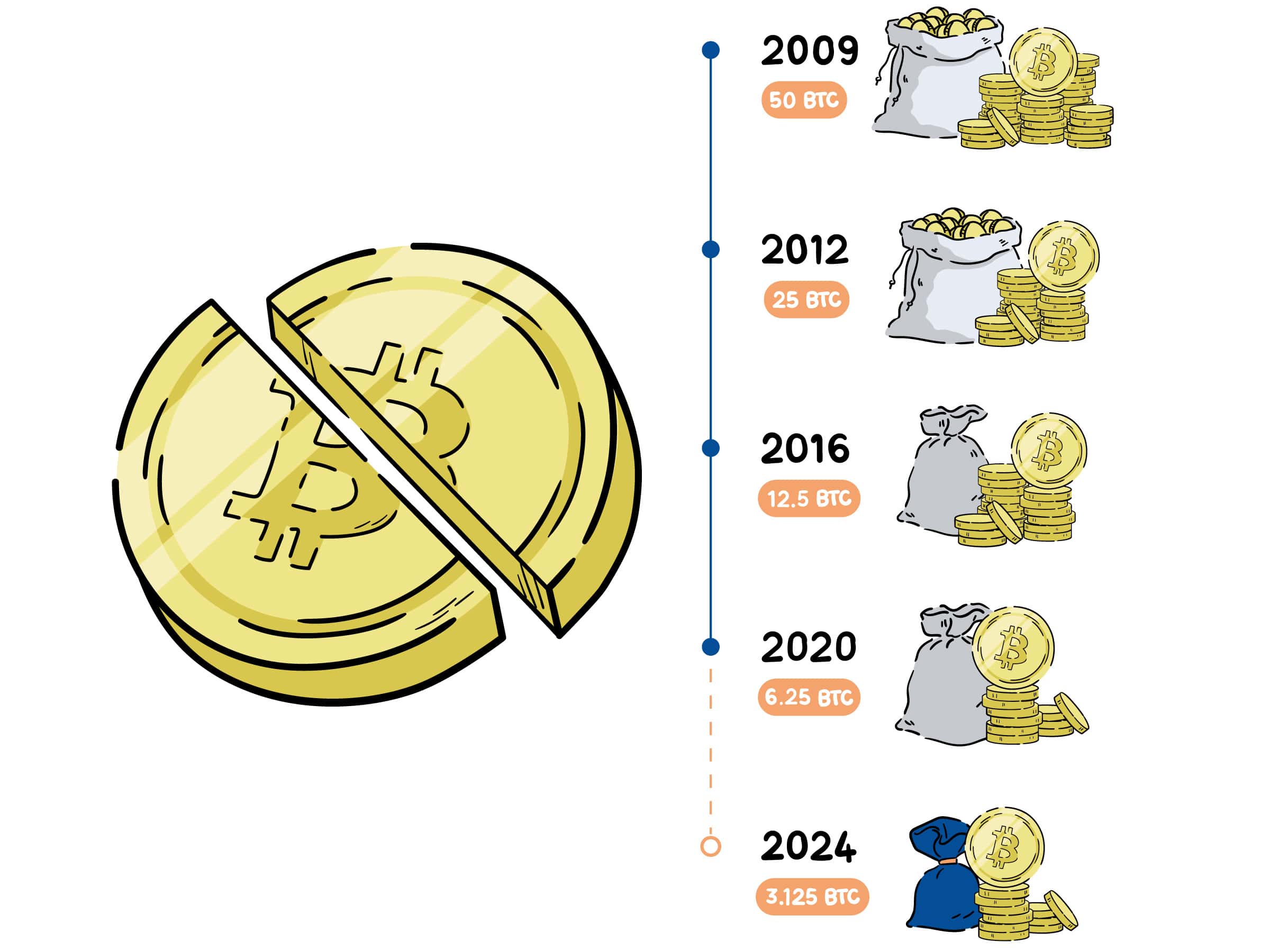

The Bitcoin halving is a halving of the reward miners receive for validating transactions on the Bitcoin network. Every four years, the amount of Bitcoin generated per block is halved, affecting both the supply of Bitcoin and inflation of the cryptocurrency.

When will the next halving happen?

In April 2028, approximately. The Bitcoin halving last occurred on April 20, 2024, reducing the block reward from 6.25BTC to 3.125BTC. The next halving is scheduled for around 2028, when the block reward will be halved again.

However, it is important to note that the exact dates may vary due to the nature of the Bitcoin network.

Why does the Bitcoin Halving happen?

The Bitcoin halving is scheduled as a measure to control the issuance of Bitcoin and limit its total supply. With each halving, the amount of Bitcoin generated per block decreases, implying that it will take more effort from miners to obtain new coins. This helps keep the supply of Bitcoin in check and ensure its relative scarcity.

How does the Bitcoin halving affect the price?

Historically, the Bitcoin halving has been associated with an increase in the price of the cryptocurrency. This is because the reduction in the miners' reward can lead to a greater shortage of Bitcoin and increase the demand.

What is Bitcoin mining?

Bitcoin mining is an essential component of the network system for reaching a consensus on the current state of the Bitcoin ledger. It consists of the process of adding transaction blocks to the public blockchain and verifying their validity. Furthermore, mining is the mechanism by which new Bitcoin coins are created, which in turn ensures the integrity of the blockchain and provides incentives for participation in the network.

Bitcoin miners are computer owners who allocate their computing power to the peer-to-peer network. Similar to gold miners who use tools to extract gold, Bitcoin miners require specialized mining equipment and access to power to perform the necessary calculations.

Bitcoin mining is critical to keeping a peer-to-peer network based on blockchain technology up-to-date and secure. By participating in Bitcoin mining, miners have the opportunity to be rewarded with new Bitcoin coins and associated transaction fees.

What has happened in other Bitcoin halvings?

During previous Bitcoin halvings, there have been significant changes to the miners' reward and the price of the cryptocurrency. The first halving happened in 2012, reducing the reward of mined blocks from 50 BTC to 25 BTC. At that time, the price of Bitcoin experienced a sharp rise, reaching an all-time high of around $30 before the event.

The second halving took place in 2016, bringing the mined block reward to 12.5 BTC. In this case, the price of Bitcoin rose as well, reaching its all-time high of around $2,250 roughly a year after the halving.

The most recent halving occurred in May 2020, reducing the reward to 6.25 BTC per block mined.

Subsequently, the price of Bitcoin experienced a significant increase, reaching a record price of around $29,000 at the end of the same year.

What will the 2024 Bitcoin halving bring?

What happens to miners with a Bitcoin halving?

The consequences of a halving for miners include:

- Income Reduction: Immediately after the halving, miners' income is halved, assuming the price of Bitcoin and the network's hash rate remain constant. This is because the reward per mined block is reduced by half.

- Increased economic pressure: Miners with less energy-efficient equipment may find mining no longer profitable due to increased operating costs relative to reduced rewards. This may lead to a consolidation of mining into larger, more efficient players.

- Possible increase in transaction fees: As the block reward decreases, transaction fees may become a more significant part of miners' income. If demand for Bitcoin transactions remains high or increases, transaction fees may rise, partially or fully offsetting the decline in block rewards.

- Potential hash rate adjustment: Some miners may shut down their machines if mining becomes unprofitable, which could lead to a decrease in the network's total hash rate. However, Bitcoin has a difficulty adjustment mechanism that makes mining easier if the hash rate drops, keeping new blocks being issued approximately every 10 minutes.

In short, halvings represent a significant challenge for miners due to the immediate reduction in revenue. However, they can also incentivize greater efficiency and potentially contribute to increases in Bitcoin's market value in the long term.

How can you prepare for the bitcoin halving?

With recurring purchases or the Dollar Cost Averaging (DCA) Investing strategy. This takes on special relevance in the context of Bitcoin halving. Considering the cyclical nature of this event and its historical positive impact on the price of Bitcoin, DCA presents itself as a prudent and strategic tactic. This methodology involves investing a fixed amount of money in Bitcoin periodically, regardless of market fluctuations. In this way, the risk associated with price volatility is mitigated, allowing investors to accumulate BTC gradually, taking advantage of both market ups and downs and the potential post-halving price increase.

Given the significant increase in Bitcoin value following previous halvings, starting or increasing recurring Bitcoin purchases before the 2024 halving could be particularly beneficial. By spreading out purchases over time, investors reduce the impact of buying at a price spike and increase the chance of lowering the average cost of their total Bitcoin investment. This not only prepares investors to benefit from an eventual increase in the price of BTC after the halving, but also provides them with a stronger position within the crypto market, diversifying their investments and reducing overall risk.

Additionally, the DCA strategy encourages long-term investment discipline, aligned with the view that Bitcoin, and the cryptocurrency market in general, has significant growth potential over the years. As we approach the 2024 halving, adopting a DCA strategy can not only offer an avenue to accumulate BTC more safely, but also allows investors to strategically position themselves to take advantage of post-halving market dynamics. In this sense, DCA becomes a valuable tool for those seeking to capitalize on Bitcoin's economic cycles, with an investment vision that transcends immediate market fluctuations.

Will the halving influence the adoption of Bitcoin and other cryptocurrencies?

It is likely that the Bitcoin halving have a significant impact on the adoption of Bitcoin and, by extension, other cryptocurrencies. Historically, halvings have generated significant media attention and an increase in interest in Bitcoin from both retail and institutional investors. This increase in attention can translate into greater adoption, as new entrants enter the market, attracted by the prospect of long-term price appreciation that halvings have tended to precede. Furthermore, the halving reinforces the perception of Bitcoin as a scarce asset, potentially increasing its attractiveness as a store of value and, therefore, its adoption as a diversifying component in investment portfolios.

On the other hand, the effect of the halving on the adoption of other cryptocurrencies may be indirect, but equally relevant. The attention Bitcoin receives during halving periods often leads to increased interest in the crypto space in general, which can benefit other cryptocurrencies as new investors explore the market.

This phenomenon, known as the “spillover” effect, can result in an increase in the adoption and valuation of altcoins and innovative blockchain projects. As Bitcoin becomes more firmly established in the traditional financial market, interest in blockchain technology and cryptocurrencies as an asset class is likely to continue to grow, driving adoption to broader levels.

Here you can see the video prior to the arrival of Halving 2024

We want to help you

FAQs

Find resolved questions about Bitcoin.

Bitcoin was created by Satoshi Nakamoto. The name is a pseudonym and his true identity is unknown. Nakamoto went public with his invention on October 31, 2008, by sending the Bitcoin whitepaper to a mailing list of cryptographers. In 2009 he published the first version of the Bitcoin client and was working on it for a while (along with other developers like Hal Finney) until 2011, when he disappeared and left the project in the hands of others. You can also meet the people most closely linked to the .Satoshi Nakamoto's identity in the article about the usual suspects.

For buy Bitcoins, you must register with a cryptocurrency exchange, such as Bit2Me, and follow the necessary steps to buy Bitcoin using a credit card or bank transfer. You can also expand to know what the detailed steps to buy Bitcoin.

Muchos merchants are beginning to offer the possibility of paying with Bitcoin. In many cases, you will need to have your Bitcoin wallet set up (which will need to contain enough Bitcoin to make the payment), and finally, you will only have to make the payment to the seller's address, indicating how many bitcoins you are going to send. Remember that, if you are going to use this method, you should always check that the address to which you are going to send is correct. You can also pay with Bitcoin using a debit card, such as the Bit2Me Card. In this case, you just have to link the card to your Bitcoin wallet, make sure you have enough funds and pay, just like you would with your usual card.

The Bitcoin price fluctuates constantly due to market fluctuations. You can check the real-time updated quote on different websites, such as CoinMarketCap or TradingView. You also have the possibility to see the graph of its relationship with the Euro in https://pro.bit2me.com/exchange/BTC-EUR.

All the Bitcoin transactionsThey are the transfer of Bitcoins between two Bitcoin addresses. These transactions are recorded on the Bitcoin blockchain, which is an immutable, public ledger. Each transaction is validated by nodes on the Bitcoin network and is confirmed when it is added to a block on the blockchain. Bitcoin transactions are irreversible, which means that once a transaction is confirmed, it cannot be undone. Each transaction has a transaction fee, which is paid to the miners who validate the transaction and add a block to the blockchain.

El Bitcoin (BTC) is the first currency based on asymmetric cryptographyand that has opened up a world of possibilities. The idea of this cryptocurrency stems from other already existing and lesser-known elements, such as HashCash, BitGold or DigiCash, which are combined within a peer-to-peer payment network (peer-to-peer or P2P).

Related articles

What is the Bitcoin Runes protocol?

Meet the Runes protocol, one of the most recent innovations within the Bitcoin ecosystem and that can completely change this ecosystem by allowing the creation of fungible tokens on the Bitcoin blockchain.

Halving Phases

The Bitcoin halving is a scheduled event that occurs every four years and where the reward for mining [...]

Next Bitcoin Halving: how it will affect the cryptocurrency

The world of cryptocurrencies has always been full of unique terms and events, and one of the most [...]